Sundry Collectors Vs Sundry Debtors What Is The Difference?

In order to grasp the term itself, it is essential to know the meaning of each these words. The term ‘sundry’ is used to explain a variety of https://www.kelleysbookkeeping.com/ gadgets that need not be mentioned individually. It’s crucial to understand the idea of creditors as it performs a pivotal position in shaping monetary transactions and maintaining a healthy financial ecosystem. The ledger accounts for Sundry Debtors and Sundry Collectors are maintained separately to trace quantities receivable from customers and payable to suppliers. You can take cautionary measures such as preserving a continuing document of the sundry liabilities, making an attempt to make immediate funds and communicating before time about any potential delays.

How Are Sundry Creditors Recorded

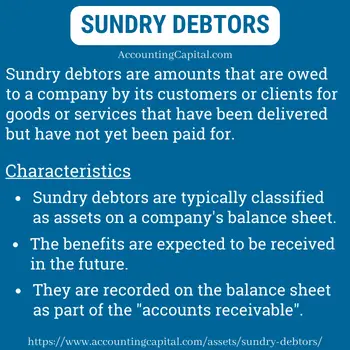

Accounts Receivable and Sundry Debtors are interchangeable as a result of the latter refers to the funds the company will in the end obtain. If your corporation defaults on cost too usually, it may possibly result in multiple issues in sustaining the relationship with the creditors. Knowing who the business creditors are might help you with sending prompt notices to companies.

- Sundry collectors symbolize bills payable, which suggests the cash that is owed by a business.

- This knowledge will equip you to take care of the dynamic business environment where your corporation operates.

- Yes, in the balance sheet sundry credit score people are recorded underneath Current Liabilities.

- It digitizes your whole business operations, proper from buyer inquiry to dispatch.

- ABC Furnishings Co. sources its raw materials, corresponding to wood, upholstery, and hardware, from totally different suppliers on credit score phrases.

Sundry Creditors Vs Sundry Debtors

A change in the amount owed to suppliers that impacts the company’s monetary statements have to be recognised to regulate varied creditors (accounts payable) to profit. Minimise liabilities by settling past-due invoices, arranging early cost reductions with suppliers, or contesting and resolving disputes. You can increase the number of creditors by postponing payments or expenses when you plan to limit earnings.

This helps you to track the fee breakup towards the payments created and handle your outstanding payables systematically. Accounts payable is an accounting time period that’s used to explain a certain amount of money that a enterprise owes another business. This term comes into play usually when a buyer has made a certain buy from the supplier, but has made the purchase through the use of a line of credit score.

What Is The Difference Between Debtors And Varied Creditors?

By revising these policies, companies can evolve their business practices up to date with the market conditions, which ensures that there is better credit management. This has made the understanding of a sundry creditor a major topic to grasp.Here is a table to clarify what’s sundry collectors. When you purchase sure goods/services out of your distributors or suppliers, you have to be certain that you discuss and agree on a particular timeline to make your funds. Particularly whenever you purchase goods on credit score, it’s important that both parties have agreed on the fee timeline, in order that there isn’t any unhealthy blood at later stages of the transaction. Sundry creditors are particular people or entities that an organization owes for goods acquired sundry creditors or providers rendered on credit score. When you have a set of sundry collectors with whom you conduct enterprise often, you’ll at all times have an agreement on the due date for each credit line.

You could find yourself doing this with a wide range of vendors and every of these transactions shall be recorded as a sundry creditor or accounts payable in your books. The total tracking and administration of this whole set of transactions is referred to as sundry creditors administration. Making certain you’re on prime of what is going on together with your sundry creditors management system will guarantee your business maintains an excellent reputation, which in flip helps you build a powerful brand. Effective sundry collectors management is a vital a part of operating your corporation efficiently in the long run.